The world of technology is buzzing with anticipation as Miro gears up for its Initial Public Offering (IPO). This highly anticipated event promises to reshape the landscape of digital collaboration tools. As one of the leading platforms for online teamwork, Miro is set to make waves in the stock market. Investors and tech enthusiasts alike are eager to understand what this IPO means for the future of the company and its impact on the industry.

Miro's IPO is not just a financial milestone for the company but also a testament to the growing importance of collaborative tools in the modern workplace. With remote work becoming the norm, platforms like Miro have seen a surge in demand. This article will delve into the details of Miro's IPO, its potential impact, and what investors can expect from this exciting development.

In this guide, we will explore the history of Miro, its business model, financial performance, and the potential risks and opportunities associated with its IPO. By the end of this article, you will have a comprehensive understanding of Miro's journey to the public market and how it may influence the future of digital collaboration.

Read also:Lips In Atlanta Discover The Vibrant Beauty And Culture

Table of Contents

- Company Overview

- Miro IPO Details

- Business Model

- Financial Performance

- Market Impact

- Risks and Opportunities

- Competitors

- Customer Base

- Future Plans

- Conclusion

Company Overview

History and Background

Miro was founded in 2010 by Andrey Khusid and Oleg Shilov. Initially known as RealtimeBoard, the company rebranded to Miro in 2019 to better reflect its mission of fostering collaboration and innovation. Headquartered in San Francisco, California, Miro has grown into a global leader in online collaborative whiteboarding platforms. The platform enables teams to collaborate effectively, regardless of their physical location.

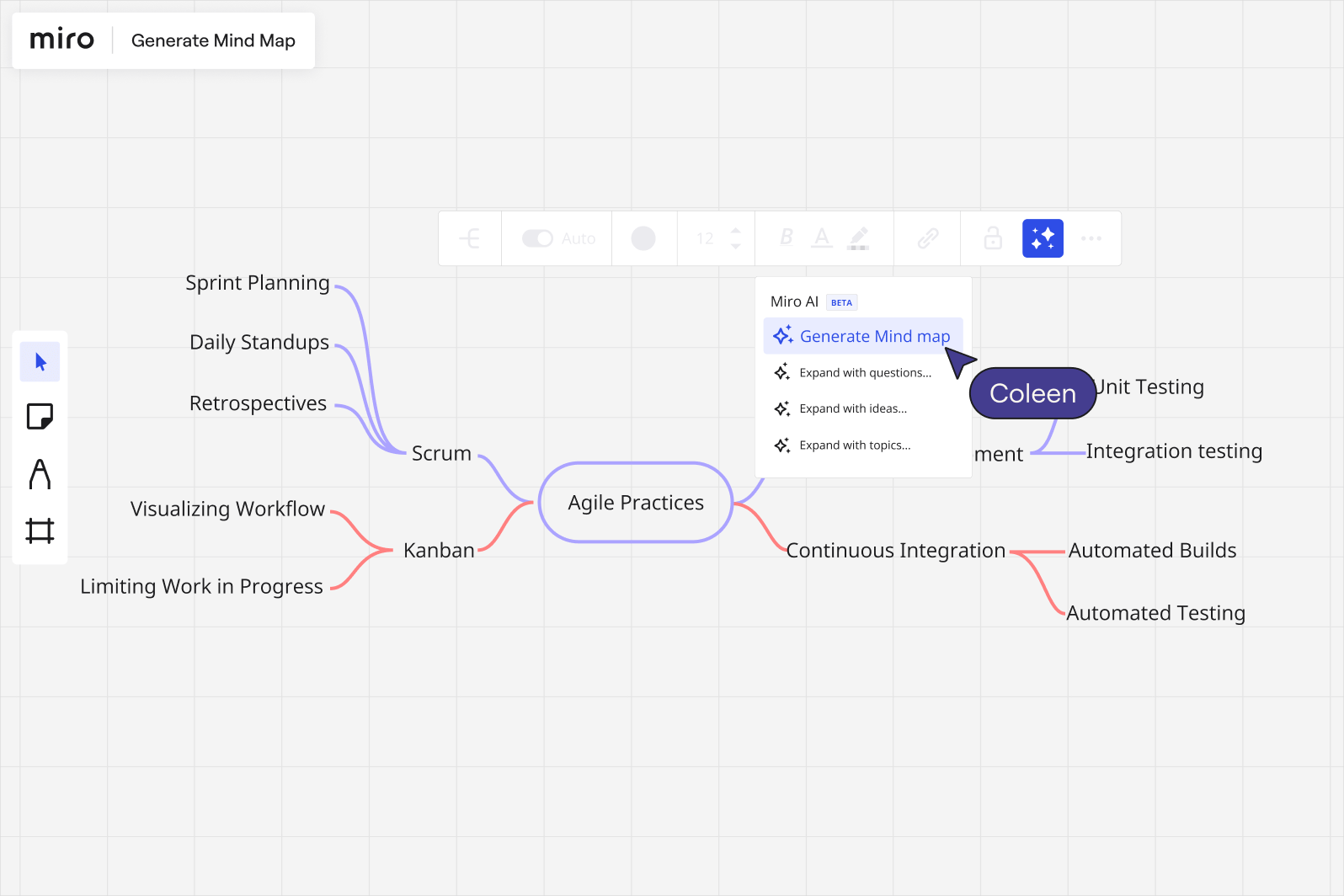

Over the years, Miro has expanded its offerings to include a wide range of features, such as brainstorming tools, project management capabilities, and integration with popular software applications. Its user-friendly interface and robust functionality have made it a favorite among businesses of all sizes.

Miro IPO Details

What Investors Need to Know

Miro's IPO is expected to be one of the most significant tech listings of the year. The company plans to raise a substantial amount of capital to fuel its growth and expand its market presence. While specific details about the IPO, such as the number of shares and the price range, have not been disclosed, industry experts anticipate a strong demand for Miro's stock.

- Expected IPO Date: Q4 2023

- Estimated Valuation: $10 billion

- Lead Underwriters: Morgan Stanley, Goldman Sachs

Investors should keep an eye on the company's SEC filings and updates as the IPO date approaches. These documents will provide crucial insights into Miro's financial health and growth prospects.

Business Model

Miro operates on a subscription-based business model, offering a range of plans tailored to meet the needs of different users. From individual freelancers to large enterprises, Miro provides scalable solutions that cater to diverse collaboration requirements. The company's revenue streams primarily come from its premium and enterprise plans, which include advanced features and dedicated customer support.

Key Features

- Interactive whiteboards

- Real-time collaboration

- Integration with third-party apps

- Customizable templates

Miro's commitment to innovation and customer satisfaction has been a driving force behind its success. By continuously enhancing its platform, the company aims to maintain its competitive edge in the rapidly evolving market.

Read also:Paul Mescal The Rising Star Of Modern Cinema Ndash Biography Career And Achievements

Financial Performance

Miro's financial performance has been impressive, reflecting the growing demand for its services. In 2022, the company reported a revenue of $300 million, marking a significant increase from the previous year. This growth can be attributed to its expanding customer base and strategic partnerships with key industry players.

According to a report by Statista, the global market for collaboration software is projected to reach $100 billion by 2025. Miro's strong financial performance positions it well to capitalize on this growing market.

Market Impact

Industry Trends

The launch of Miro's IPO is expected to have a significant impact on the collaborative software market. As more companies embrace remote and hybrid work models, the demand for digital collaboration tools is expected to rise. Miro's IPO could set a new benchmark for other players in the industry, encouraging innovation and competition.

Investors and analysts are optimistic about Miro's potential to drive growth in the sector. Its strong brand recognition and robust product offerings make it a formidable player in the market.

Risks and Opportunities

Challenges Ahead

While Miro's IPO presents numerous opportunities, it also comes with its share of challenges. The company will need to navigate a competitive landscape, where established players like Microsoft and Google dominate the market. Additionally, Miro must address concerns related to data security and privacy, which are critical issues in the digital age.

On the other hand, Miro's IPO opens up new avenues for growth. The company can leverage the capital raised to invest in research and development, expand its global footprint, and enhance its product offerings. By focusing on innovation and customer satisfaction, Miro can solidify its position as a leader in the collaborative software space.

Competitors

Miro faces stiff competition from several established players in the collaborative software market. Some of its key competitors include:

- Microsoft Teams: Integrated with the Microsoft Office suite, Teams offers a comprehensive solution for team collaboration.

- Google Workspace: With its suite of productivity tools, Google Workspace provides a robust platform for online collaboration.

- Slack: Known for its messaging and communication capabilities, Slack is a popular choice for teams looking to streamline their workflows.

To stand out in this crowded market, Miro must continue to differentiate itself through innovation and superior user experience.

Customer Base

Miro's customer base spans across various industries, including technology, finance, education, and healthcare. Its versatility and scalability make it an ideal choice for businesses of all sizes. Some of its notable clients include:

- Uber

- Adobe

- NASA

By catering to a diverse range of industries, Miro has been able to build a loyal customer base that values its products and services. This strong customer relationship will be crucial as the company moves forward with its IPO.

Future Plans

Expanding Horizons

Miro's IPO is just the beginning of an exciting journey for the company. With the capital raised from the offering, Miro plans to invest in several key areas:

- Research and Development: Enhancing its platform with new features and capabilities.

- Global Expansion: Expanding its reach to new markets and regions.

- Partnerships: Forming strategic alliances with industry leaders to drive innovation.

These initiatives will enable Miro to stay ahead of the curve and continue delivering value to its customers.

Conclusion

Miro's IPO represents a significant milestone in the company's history. As a leader in the collaborative software space, Miro is well-positioned to capitalize on the growing demand for digital collaboration tools. Its strong financial performance, innovative product offerings, and expanding customer base make it an attractive investment opportunity.

In conclusion, Miro's IPO is a testament to the company's commitment to innovation and customer satisfaction. As it embarks on this new chapter, Miro has the potential to reshape the collaborative software market and redefine the way teams work together. We encourage readers to explore Miro's offerings further and stay updated on its IPO developments. Don't forget to share your thoughts in the comments section and explore other articles on our site for more insights into the world of technology and finance.